Now and then people see a problem, and on the other side of the problem lies an opportunity. Very few people are able to see that opportunity. They get excited with the opportunity and think that it would be a great business idea.

Let us assume someone has come up with an idea and he wants to start a business. Again remember when it comes to Finance/Accounting business is treated separately from the business owners. To start a business two kinds of capital is required (1) Intellectual capital (2) Financial Capital. I will not be telling you much about intellectual capital because then it would be wavering from the topic.

Financial capital is nothing but having money to start the business. In other words starting a business requires money. When business needs money, it borrows. It borrows from two sources (1) Insiders – Mainly Owners, business partners and investors and (2) Outsiders – Predominantly from a financial institution like a bank. Now let us see how it appears on a balance sheet.

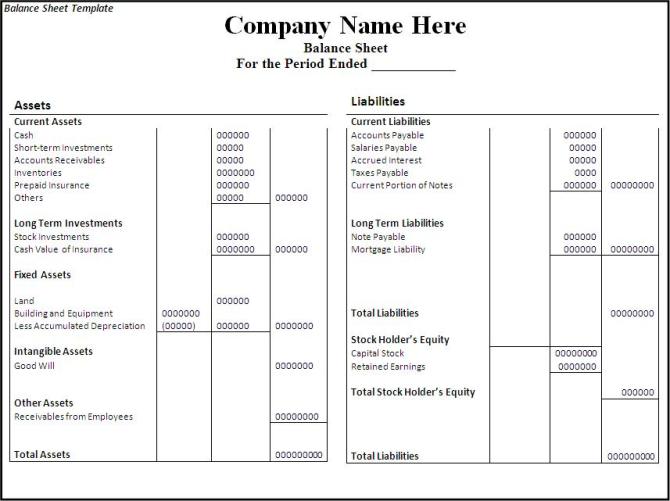

Balance sheet has two headings – Liabilities and Assets. Liabilities are nothing but source s of funds. Where did the business source its money? Money sourced from insiders is called Share Capital and money sourced from outsiders is called loan.

Assets on the other hand are uses of funds. Where did the business use the money it sourced? Most of the times it is used in acquiring fixed assets. We also discussed that sometimes the business borrows in kind and they are called Current Liabilities. Similarly on the assets side there is Current Assets.

Further simplifying the Balance Sheet in four sections: (1) Share capital and Loans as Long-Term Liabilities (This is called Long-term liability as the business is not liable to pay these within one financial year. Anything payable in a period longer than one financial year is called Long-term Liabilities.) (2) Short-term Liabilities (Current liabilities is the money business is supposed to go out of business within one financial year. Hence they are called Short-term liabilities) (3) Long-term Assets (Fixed Assets) and (4) Short-term Assets (Current Assets).

We did not purchase Land, building and equipments which are fixed assets to sell within one financial year. That is the reason they are called Long-term assets. However, if you are in real-estate business or a car retailer then definitely it would not be classified as Fixed Assets. It would be classified as Inventory under Current Assets. Ideally speaking life of equipment should be equal to life of a loan.

For example, you want to start a taxi business. You are buying a car to use it for five years then take a loan for five tears. This is because you can pay a part of the money earned from the passengers as interest to the bank. That is what should be done.

Similarly, Long-term Liabilities should be invested in Long-term Assets and Short-term Liabilities should be invested in Short-term Assets. But in case of business 1 + 1 is never equal to 2. The client who tells you that he is going to give you business next week may not even give the proposed business even in a month’s time. Also the client who is supposed to pay on the 21st day may not pay on that day. It might be 22nd, 25th, 30th or even much longer.

What I want to make clear is that there is no ideal situation in Business. In that scenario it is acceptable to invest Long-term liabilities in Short-term assets. Why am I saying acceptable? It is because long-term lenders will ask for their money only after one financial year. If we have invested in short-term assets, we can liquidate (cash) that short-term asset within one financial year. When we have to pay the long-term lenders, we will have the money to pay them.

However it is a crime to invest short-term liabilities in Long-term assets. This is the second common mistake in business. Why? This is because short-term lenders will come for their money within one financial year. If you have invested their money in Long-term assets you will not have sufficient cash to pay the short-term lenders. In this scenario owners are left with only two options: (1) Pay the money from their own pocket or (2) Sell the fixed assets to pay the short-term lenders. Selling fixed assets to pay short-term lenders is the beginning of an end. This is what leads to cash-flow issues.